After many months of Washingtonians voicing their concern with the new long-term care tax in the state, it seems the message has finally been heard. Read on for an update from Dr. Schweitzer.

“With only a week left before the Long Term Care Act de-facto income tax goes into effect on most employees working in Washington state, there’s a lot going on.

The state’s legislative leaders on both sides of the aisle have stated they are open to changing the law, and the Governor is encouraging the state to delay collecting the tax in Q1. The main intention for delaying collection for the tax is to allow the Washington State Legislature enough time to convene for the 2022 session this January and address the program’s shortcomings. It is expected that changes will be made to the existing law to address various issues that have been raised, and there is already a flurry of prefiled bills.

To be clear: this tax is not dead yet. But, it sure is unpopular!

Strike One

Voters weighed in on it…voting NO to a long-term care tax in 2019. Unfortunately, that vote was “advisory,” and certain politicians gave in to what I believe are special interests, and defied the advice from We the People.

Strike Two

Over 440,000 workers opted out…12% of the workforce! Maybe an equal number would have if they even knew about the tax. Maybe a 100,000 more wanted to, but couldn’t find private insurance. I couldn’t: I’m too old, but still working.

That adds up to about a million workers, or about 30% of the workforce! That amounts to Vote #2 against the tax.

Two dozen senators now oppose the tax they passed. The governor realizes it’s bad, too, and called for a delay.

On December 17, Governor Inslee announced an agreement with state Democratic legislative leaders to delay the WA payroll tax on employees for the WA Cares program.

The interim fix appears to be encouraging employers to delay collecting premiums for the program. A press release from Governor Inslee’s office stated he supported employers not being subjected to penalties and interest for waiting to withhold the payroll tax from employees’ wages. And while Governor Inslee has stated he is unable to make changes to the law and changes are left to the legislature, he has directed the state Employment Security Department not to collect the tax for this program until April 2022.

At least half a million workers made mad scrambles to get out of the tax. While the Opt Out period is open through the end of 2022 as the law is currently written, the fine print is a private long-term care policy must have been purchased and in use by November 1, 2021.

Strike Three

Fortunately, whether you opted out or not, you can vote against this new payroll tax a THIRD time…by signing Initiative 1436. Signatures must be submitted by December 31, so we have only SEVEN days left to sign!

You can print and sign a petition right away from the “Yes on 1436 Initiative” website, and mail it as soon as possible to:

Yes on 1436

218 Main Street, #919

Kirkland, WA 98033

All signed petitions have to be turned into Washington Secretary of State Hobbs by December 31, 2021 to be eligible. Print and sign today and push back on this unwanted and unnecessary tax.

Thank you, and Merry Christmas and Happy New Year!

– Ed”

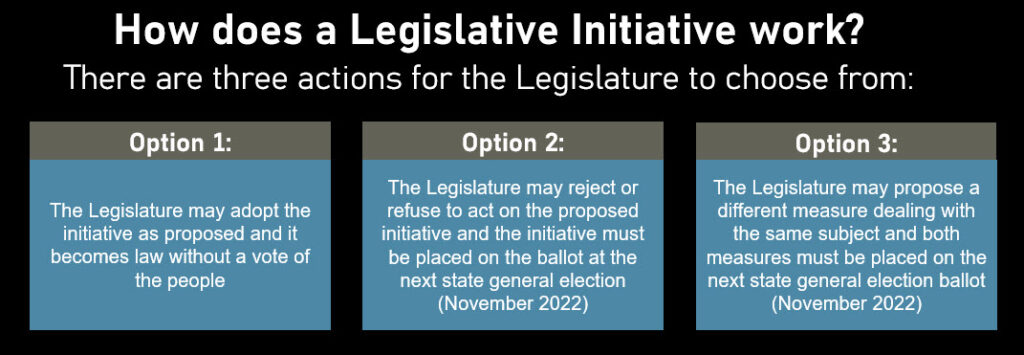

The Nuts and Bolts of the Initiative

This legislative initiative would change the long-term care tax to opt-in, opt-out, for any reason at any time – leaving Washingtonians free to choose if long-term care is a service they want to save for.

Clear as Mud

On December 23, Governor Inslee released an additional statement clarifying that if the Legislature fails to make changes to the tax, employers “will still be legally obligated to pay the full amount owed to state ESD to begin the long-term care program.”

The continued momentum to change the tax has made a difference, as numerous employers and employees continue to voice their frustration with this tax. This continuous feedback will be more important than ever as the Legislature reviews proposed changes to the program.

And while a total repeal would be the most fair, free, flat, and open market solution, it is unlikely the Legislature will come to that conclusion without feedback from their constituents. It will remain up to Washingtonians to speak with their elected officials in the State Senate and House to educate them on the impact of this program and tax to paychecks and families. Change is possible if we continue to make the problems visible, and the solutions clear.